New Age Piracy The New Modus Operandi

09/03/18 09:08 Filed in: fraud | mortgage | embezzlement | courts | unlawful detainer | irs | 1099 | us treasury | Wrongful foreclosure | embezzement | tax evasion | mortgage fraud

On Friday 3/9/18, a very important submission was made to our California State's Capital. Because of the sensitivity of what was contained therein, we were asked respectfully to remove parts of our last post.

We the People of these "United Nations" are begging to wake up to just how abusive this System has become, but many still are trying to figure out just what the heck when wrong. While @DisLeague could rant and rage about whom done ya wrong (yeah we have our own target lists @NATO beginning with @GoldmanSachs) we instead are going get embark on Dat @NextGenTrain enlightenment to help #PassTheTourch to our @Emma4Change in online support as to why we are being forced to #MarchForOurLives in the first place. @DisLeague is offering you a choice in a pivotal moment in history. Just like the movie the Matrix you can take the blue pill, and block this site, the story ends, you wake up in your bed and believe whatever you want to believe. Or, you take the red pill—you stay in this man made #wunderland, and @Disleague will show you just how deep their rabbit hole goes.

Today we live in the next generation of land pirates through which have been created through series of deregulations and intellectual property adjustments to which has turned us not into a nation of living breathing people, but into what is called a Cost of Funds Index or COFI. You see when you are born, your parents registered you with the government as a CORPORATION by receiving and signing a birth certificate, from there your Corporation receives a taxpayer ID# called a social security number. This is so that you can be used as collateral for the government to acquire debt.

Yup, you are reading this correctly, YOU and your labor, time and energy is what backs up the National debt. YOU are Stock which is either classified as performa or non-performa. Performa stock is placed upon a variety of mezzanine plat forms to which fuels various financial systems. Non-performa Stocks are considered junk assets to which create system anomalies or blights within their system. The governments solution to this is to transfer their junk assets onto the non-performa stocks (AKA We the People whom have been declared dead) in that they can take additional write-offs against their losses by moving them over to Performa stocks (AKA We the People whom are being intellectually traded "above the land") in the creation of new dividend repayments back into their system in order to pay back the collateral granted to them by your birth off which they borrowed against to create this national debt.

Now some of our economists whom have been following this pre-meditated mortgage crash through which the MERS system, aka the Mortgage Electronic Registration System which is really nothing more than a Membership Enterprise Riged "People Stock" scheme through which "People Stock" were used to back the collateral obtained off the trading rights against a peace of real property where colorable monies known as FIAT currencies were laundered internationally and exchanged for certificates which in turn were attached to the manipulated LIBOR index. This is a Bank to Bank index called London Interbank Offered Rate. It's the rate of interest at which banks offer to lend money to one another in the wholesale money markets in London and in turn set the cost of various variable-rate loans.

Our Federalized financial friends at Barclays and Goldman Sad Sacs learned that by controlling the payouts to the investors of those certificates and by shorting the US Housing Bond Market, they could force an investor loss by triggering defaults upon the contracts that were used with their performa stock partnerships (AKA We the People) after seasoning us for a year within a special pooled vehicle. There were over 500 of these passthrough grantor vehicles created upon the Securities and Exchange commission, which effectively substituted We the People into the US Housing Bond Market and opened us up to Federal Repossessions through the courts.

Once the tigger hit, the certificate value fell triggering a loss on the open market to where these REMICs were then especially refinanced (along with our state pensions) under a different index called the ISDAfixed, International Swaps and Derivatives Association. This Index is a rate value for fixed interest rate swap rates, now renamed "ICE Swap Rate". This index was used to determine the value of the Worlds Currencies AKA Government FIAT currencies know to us as Euros, Brittish Punds, Swiss francs, and our US Dollar.

There is a reason the “broker” ICAP, the London-based firm under investigation, was nicknamed Treasure Island, because by electronically manipulating the value of interbank interest rate offerings to set the value of adjustable rates across the board, then using them when they tanked to refinance and enjoin state pension plans in the repayment of these "losses", then they could then refinance through ICAP, the value of world currencies to take the electronic difference and filter it internationally, electronically. Unfortunately once our governments caught wind of what was going on, they in turn printed $3,027,200 more $100 in 2012 to cover it up (What, you think they just reprinted that mass inflow because someone said, hey bob those $100 bills are looking a little shabby, lets recall and recirculate)

The thing to really keep in mind here, and that FIAT currencies are backed by nothing other than trust. Nixon made sure we were removed from the gold standard to launch this new Trust Nation. Historically whenever you have a government that decided not only to print up monies to expand a deficit to which the people are backing as Asset collateral upon promises to pay a debt never owed in the first place, is called an abusive tax matter partnership interest, its system crash time.

So what exactly happens when you breach the words written upon the Promissory note called the US Dollar with the words In God We Trust printed upon them? - Well frankly you get an Economic crash of these attached world currencies because the US Dollar is our go to currency. in our case, crypto currency wars, international positioning of alternate currency takeovers, i.e. ( rates for HongKong Dollar and Japanese Yen were suspended in 2013/2014 Interestingly enough around the same time our Federal Reserve and international banks like JP Morgan were discovered to be heavily involved in the internationalization of the Yuan where China has opened Yuan “clearing houses in multiple countries to allow faster convertibility of the Yuan, quietly supplanting the dollar as the world reserve currency with clearing houses in London, Hong Kong, Singapore, Taiwan, and Kenya. Good times.

So when the banks foreclosure mills were blocked, and they went to outside sources to kick you to the curb in order to fraudulently dispossess you of your property, they threw you in front of the courts to probate your estate.

You see, all these courts are privately owned trading companies. The United States district courts are all owned...those are your article one courts. They're all owned by the united States attorney's executive offices out of Washington DC which is a privately owned corporation.

They're article one legislative tribunals. They're not courts. They have a DUNS number, they have a pit code, sip code, NAICS number (North America Identification Security Classification). You have to have that number in order to trade internationally. All these courts are registered with the DOD, Department of Defense. They have a DUNS number which is Data Universal Numbering System. That's a Dun & Bradstreet. You have to be registered with CCR, Contractors Central registration under the DOD.

They have another department called the DLIS, Defense Logistics Information Service. The DLIS issues a case code that's spelled CAGE, Commercial And Government Entity which corresponds to the bank account. They have a bank account. They take everything that you file into the court and they securitize it, and all these banks are registered, they have a depository agreement, a security agreement and an escrow agreement.

Most of them are registered with the Federal Reserve bank of New York city. And they use what they call...North Carolina uses a circular 16, they use as their depository agreement. They take public funds and they deposit them under a depository resolution agreement. And they have a security agreement which the clerk of the courts signs with the bank. And they have an escrow agent that acts as the go-between the federal reserve bank that they have the account with...so all these courts are taking your money and funneling it into an escrow account. Most of them are in New York.

There's 60 trillion dollars of your money in the federal reserve bank of New York City and they've told the courts not to rule against the banks on these foreclosure cases.

What these lawyers are doing is acting as private debt collectors. And under the Debt Collectors Practices Act, its called the FDCPA and its title 15 section 1692 when you're a public debt collector you have to be registered with the government, and you have to have a license and you have to have a bond in order to collect debt.

Well these attorneys are what you call private debt collectors they are exempted by the BAR association on that provision, but their firm is not. The firm they work for has to be registered and they have to have a license and a bond and they don't.

All these court cases that people have been involved in, these attorneys are acting as private debt collectors. And what they're doing is collecting money from you as private debt collectors and they're not licensed or bonded to do that.

They are doing this through what they call Warrant of Attorney. Black's law dictionary of 1856 defines a warrant of an attorney is like a writ of execution. Its like a put or a call in the world of securities. When you do a marching call that means they use it to buy equity securities. (Cause they securitize everything that you file into court) which means they turn it into a negotiable instrument. Then they sell it as a commercial item. They call them distressed debt, these debt collectors.

That is what Unifund is, they come in and buy up all these court judgments as distressed debt. Then they put them into hedge funds and they sell them to investors globally. And of course when you get into selling debt instruments you're creating a security risk. Anytime you get into risk management you have to have re-insurance. That's where Luer Hermes comes in they're an underwriting company. And they're a sub division of Alliance SE out of Munich Germany, they're the US agency that acts as a bond holder for Alliance SE who in turn is PIMCO bonds who takes all your securities, they pool them, and that's what they do on these fake mortgage loans after they trigger foreclosures to reinstate a new depreciation write off, they were never entitled to in the first place.

If you go to title 15 section 77 A b 1 it tells you that any note with a maturity of more than 9 months is a security by legal definition and an investment contract. So when you sign and indorse these notes as the drawer and the maker you're in an investment contract, you gave them a security. They take the security and they securitize it. As soon as they securitize it and indorse it for payment, they've securitized it. The loan is no longer secured.

They've collapsed the trust and there's no corpus in the trust under probate law. PIMCO takes the mortgage backed security pools over and sells them as bonds. So bonds actually come from pooled securities. And they sell these on the TBA market globally. And all these courts are involved in that with a new S.E.C.U.R.E software system owned by the counties whom also get a kickback for recording fraudulent deeds upon title.

The only time you can stop them is when you make them liable and that's what we have been doing.

Means that @DisLeague is fixing to whip up some letters rogatory which is a letter of instruction under the Hague convention under title 18 section 1781 and Federal Rules of Civil Procedure 28 B under a 10b5 SEC attorney enjoiner. We intend to tell these courts they are indeed contracting with us as third party incidentals whom are liable under the IRS rules to where these claims we are showing you how to do, become their debt owed to us…

In layman's terms… BITE US and you WILL be bitten back. Those whom participated do NOT get a get out of jail free card. PERIOD!

In re: USA @DISLEAGUE v. SECRETARY OF THE TREASURY

05/03/18 11:23 Filed in: fraud | mortgage | embezzlement | courts | unlawful detainer | irs | 1099 | us treasury | Wrongful foreclosure | embezzement | tax evasion | mortgage fraud

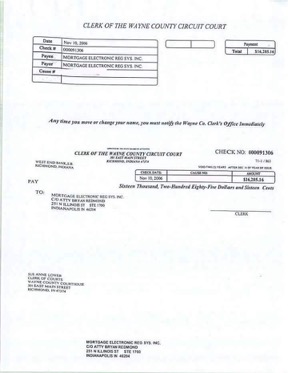

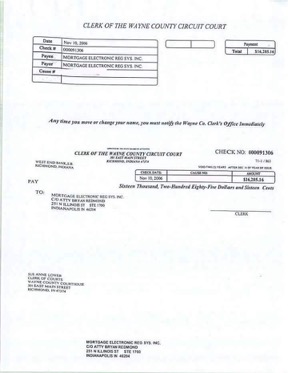

EXHIBIT - 1

As we continue to refine and draft this LIBEL OF REVIEW & BID PROTEST under F.R.C.P. 17. let us give you a taste of a some of our cases we intend to bring forth under USA @DISLEAGUE v. SECRETARY OF THE TREASURY in re: COLLATERAL DAMAGAGES BID PROTEST

Questions before the courts in re: MODUS OPERANDI

And since @DisLeague has also discovered the Bureau of Land Management holds a death list on land owners holding usage rights - click here for the Bundy interview perhaps CONGRESS you would like to share these lists with the general public in that they can properly take what ever means necessary to defend themselves.

Mr President, members of Congress, You need to understand that @DisLeague has been in review of some pretty hard corse "collateral" cases in this ongoing aftermath of prolonged mortgage tax evasion scheme, but this one is pretty high up there. This case has multiple attempted murders, multiple death threats in addition to severe emotional duress., but what is most heart felt, is the sentiment expressed in just how it fees to be fraudulently dispossessed. This man went from a multi million dollar mansion to living in an 800 SQFT apartment, and while the value of this home really makes no difference as to whether it is $25k-$10M it comes down to just how sever the impact of this pre-meditated mortgage crisis impacted us as a Nation. @DisLeague now issues a personal challenge to the President of these United States and to CONGRESS - WE DARE YOU to read this to see if you have the stomach to fess up to these crimes against humanity that have plagued our lands for far too long. His opening brief is something we may have to incorporate to show the people a proper format for their own personal stories as an example to draw upon… The people know that we are not attorneys, we are a discovery league.

And even though he wished to remain off the internet, @DisLeague believes that there is not one of us who cannot connect to his declarations for closure.

As we continue to refine and draft this LIBEL OF REVIEW & BID PROTEST under F.R.C.P. 17. let us give you a taste of a some of our cases we intend to bring forth under USA @DISLEAGUE v. SECRETARY OF THE TREASURY in re: COLLATERAL DAMAGAGES BID PROTEST

Questions before the courts in re: MODUS OPERANDI

- In Re: (Exhibit 1) Where does the pay for the Judges of the Federal District Court come if MERS is cutting checks through the Clerk of the County Circuit Courts? See: 26 USC §§ 7214 and 7433).

- Why are the Notices of Lien “Under Revenue Laws” not signed, but stamped for a third party?

- Since when are warranty deeds of conveyances mortgages?

And since @DisLeague has also discovered the Bureau of Land Management holds a death list on land owners holding usage rights - click here for the Bundy interview perhaps CONGRESS you would like to share these lists with the general public in that they can properly take what ever means necessary to defend themselves.

Mr President, members of Congress, You need to understand that @DisLeague has been in review of some pretty hard corse "collateral" cases in this ongoing aftermath of prolonged mortgage tax evasion scheme, but this one is pretty high up there. This case has multiple attempted murders, multiple death threats in addition to severe emotional duress., but what is most heart felt, is the sentiment expressed in just how it fees to be fraudulently dispossessed. This man went from a multi million dollar mansion to living in an 800 SQFT apartment, and while the value of this home really makes no difference as to whether it is $25k-$10M it comes down to just how sever the impact of this pre-meditated mortgage crisis impacted us as a Nation. @DisLeague now issues a personal challenge to the President of these United States and to CONGRESS - WE DARE YOU to read this to see if you have the stomach to fess up to these crimes against humanity that have plagued our lands for far too long. His opening brief is something we may have to incorporate to show the people a proper format for their own personal stories as an example to draw upon… The people know that we are not attorneys, we are a discovery league.

And even though he wished to remain off the internet, @DisLeague believes that there is not one of us who cannot connect to his declarations for closure.

This case has been moved to the State Capital

___________________________________________________________________________________

THIS INFORMATION HAS BEEN DEEMED TO SENSITIVE to publish